Charts: Homebuyers Becoming Even More Active

Originally Published by: NAHB — May 7, 2021

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

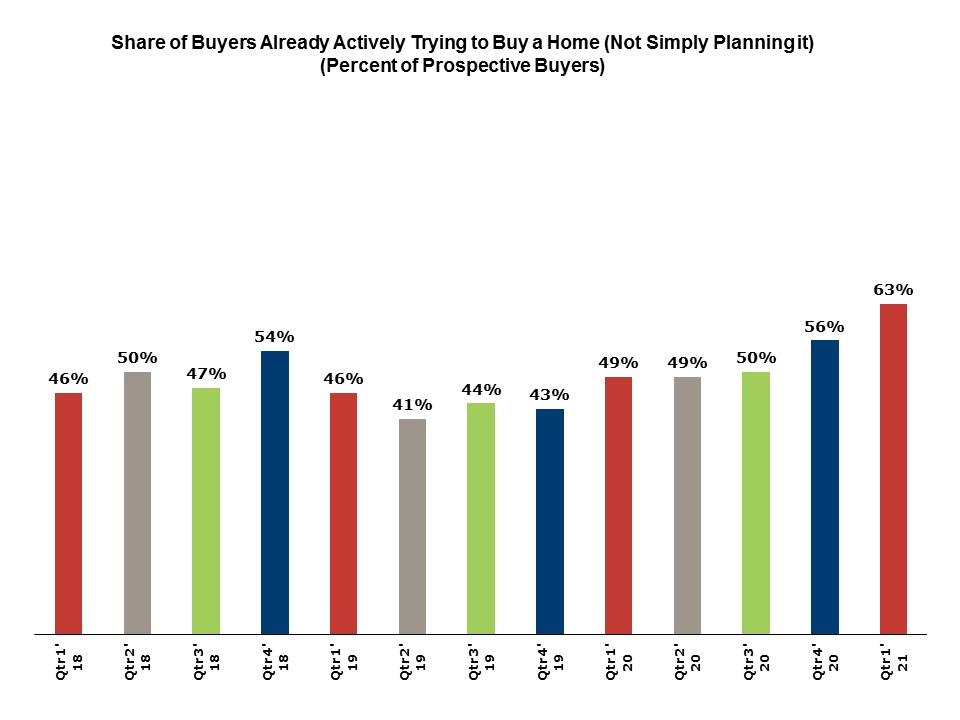

Of the 16% of American adults considering a future home purchase in the first quarter of 2021, 63% have moved beyond planning and are actively trying to find one to buy, up from the comparable 49% share a year earlier. This increase marks the fifth consecutive year-over-year gain in the share of prospective buyers who have become active buyers. Several factors are driving this trend, including fear of missing out on still relatively low mortgage rates, desire for more space due to COVID-19, and desire to move out to outlying suburbs.

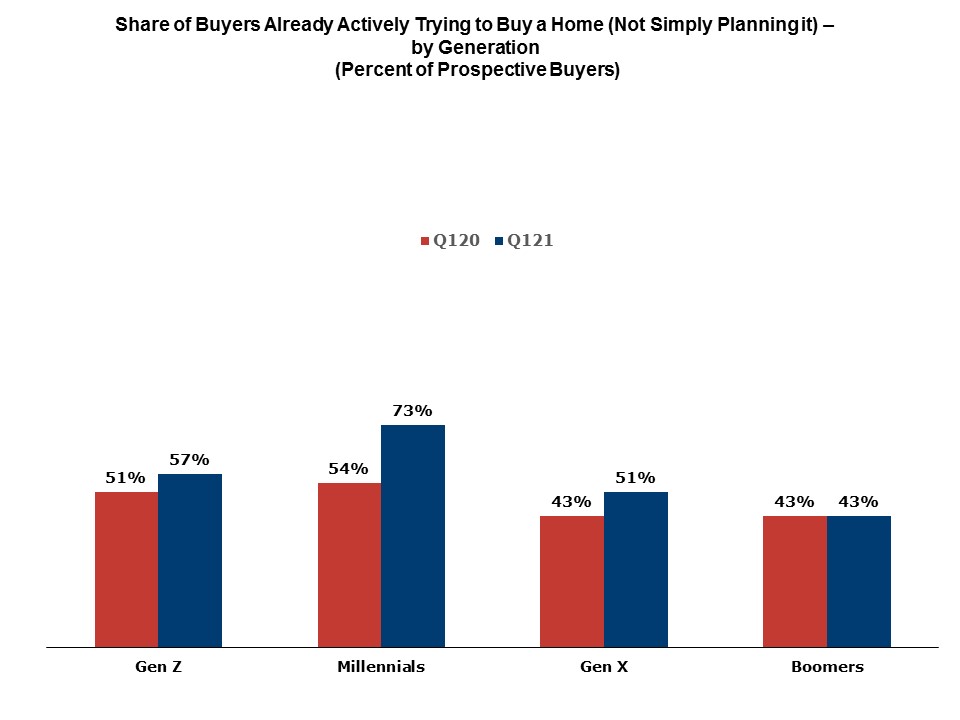

Millennials are the most likely generation to have moved on from just planning a home purchase to actively searching for a home to buy: 73% of this generation’s prospective buyers were already active buyers in Qtr1’21, up from 54% a year earlier. In contrast, the share rose only moderately among Gen Z and Gen X buyers, and not at all among Boomers.

Geographically, larger shares of prospective buyers in every region are actively trying to find a home to buy than a year ago, but the increase is most notorious in the Northeast (56% to 74%) and the West (51% to 69%).

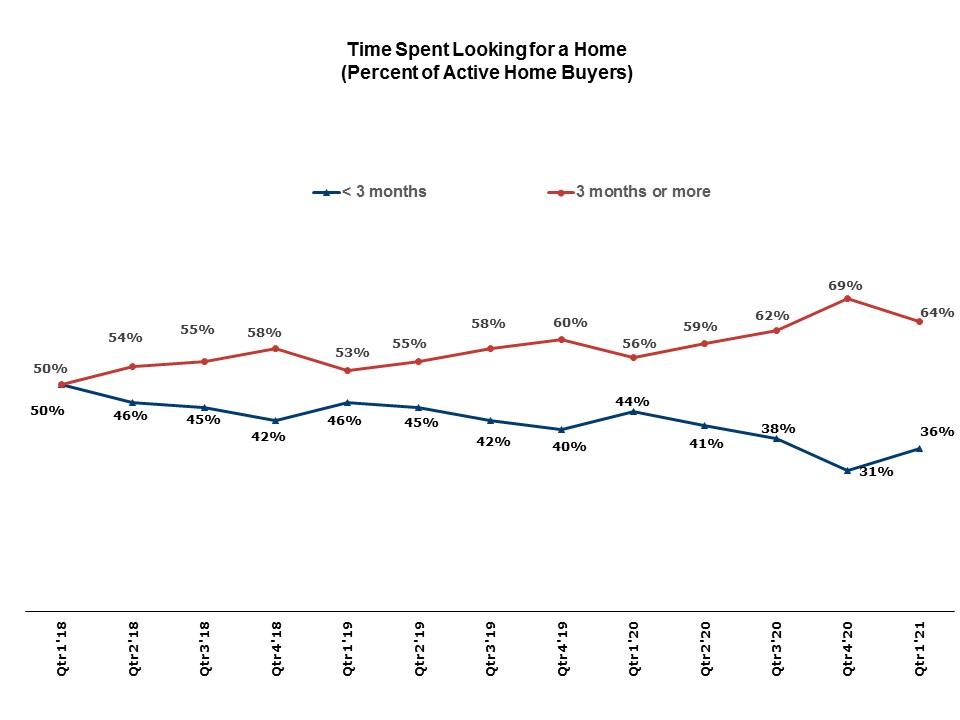

As the share of prospective buyers actively searching for a home continues to increase, the length of time spent searching continues to grow. In the first quarter of 2021, 64% of buyers actively engaged in the purchase process have spent 3 months or longer looking, compared to 56% a year earlier. This marks the ninth consecutive year-over-year gain in the share of active buyers looking for 3+ months for a home to buy.

* The Housing Trends Report is a research product created by the NAHB Economics team with the goal of measuring prospective home buyers’ perceptions about the availability and affordability of homes for-sale in their markets. The HTR is produced quarterly to track changes in buyers’ perceptions over time. All data are derived from national polls of representative samples of American adults conducted for NAHB by Morning Consult. Results are not seasonally adjusted due to the short-time horizon of the series, and therefore only year-over-year comparisons are statistically valid. A description of the poll’s methodology and sample characteristics can be found here.