Will Build-for-Rent Ease Housing Shortage?

Originally Published by: John Burns Real Estate Consulting — March 18, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

With the backdrop of anemically low resale supply (check out our resale agent survey), as well as for-sale new home supply, we are monitoring growth of the build-for-rent (BFR) market to help alleviate the housing shortage. BFR neighborhoods are new homes that live more like single-family homes than apartments. They range in size from single-story, small attached homes with carports to large, detached homes with garages and big yards.With the backdrop of anemically low resale supply (check out our resale agent survey), as well as for-sale new home supply, we are monitoring growth of the build-for-rent (BFR) market to help alleviate the housing shortage. BFR neighborhoods are new homes that live more like single-family homes than apartments. They range in size from single-story, small attached homes with carports to large, detached homes with garages and big yards.

Build-for-rent (BFR) is a new, booming asset class.

- 51% of the 651 BFR communities in our database were built in the last 5 years.

- 27% of BFR communities were built in the last 2 years.

- Based on the build-for-rent consulting assignments we've completed in the last 4 years, and a surge in long-established apartment developers now subscribing to our research, we are highly confident that supply will increase dramatically.

Build-for-rent developers are buying plenty of land.

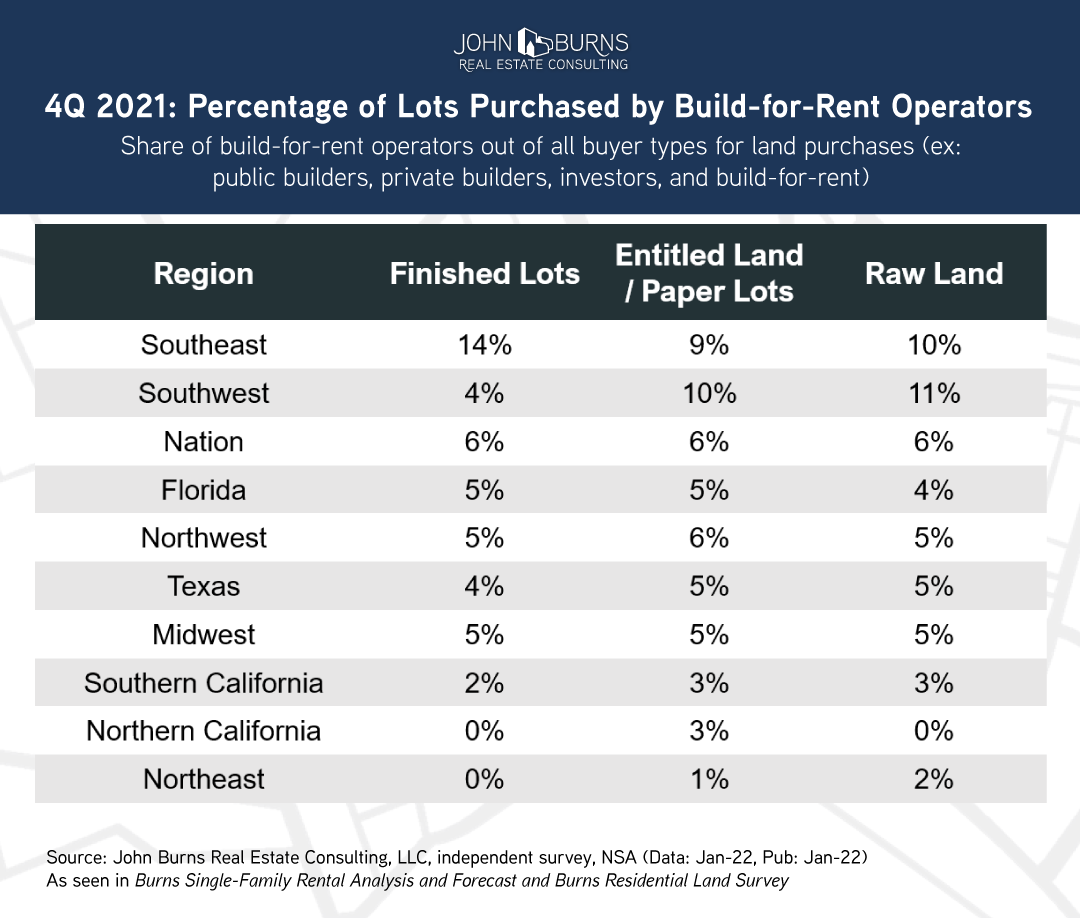

Build-for-rent operators are actively buying land across the country, according to our Residential Land Broker Survey. Many of these BFR operators are competing for the same lots both public and private builders are also bidding for, particularly on higher density parcels.

The build-for-rent share of land purchased has grown over the course of the last couple years, as a flood of capital and rising single-family rents drive demand for development sites. BFR operators are buying land most actively in:

- Southeast = 9% to 14% of lots (finished lots, entitled land / paper lots, raw land)

- Southwest = 10% to 11% of lots (entitled land / paper lots and raw land)

Public builders are also pursuing single-family rental and build-for-rent despite a hot for-sale market. They are building entire communities for rental operators, selling one-off homes to operators, or building, renting and then selling the homes themselves.

As home prices continue to soar (even in a rising mortgage rate environment), BFR will add much needed rental supply to the very low inventory environment we are currently in. Given the need for additional space and the increase in working from home, build-for-rent homes give consumers the ability to live in a newly built home, while enjoying the benefits of amenitized communities and flexibility to move.

To learn more about the single-family rental and/or build-for-rent market, fill out this form or contact Danielle Nguyen, and we can show you our research membership content or put you in touch with the right consultant.