2025 Lumber Report Shows Duty Hikes Hit Softwood

Originally Published by: HBS Dealer — August 4, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

The enormous increases in the softwood lumber duty on Canadian wood shipments into the U.S. have finally arrived. This during a normal slower time for both housing construction activity and sawmill manufacturing. As hot summer weather across most of the continent sent folks off to vacation, lumber industry players worked out their responses to this additional constraint of cross-border trade.

Currently the two nations are in Softwood Lumber Dispute V (five), which — over the last few decades — has succeeded in reducing Canadian shipments of lumber to the U.S. Historically, 85% of Canadian wood was sold to the U.S. Over the successive disputes, this ratio dropped to less than 65%. In the past, it was still less expensive for Canadians to pay the U.S. duty than the high shipping costs to offshore customers.

At this point, with the lumber duty so high, it is now actually less expensive for Canadians to send wood into alternative markets.

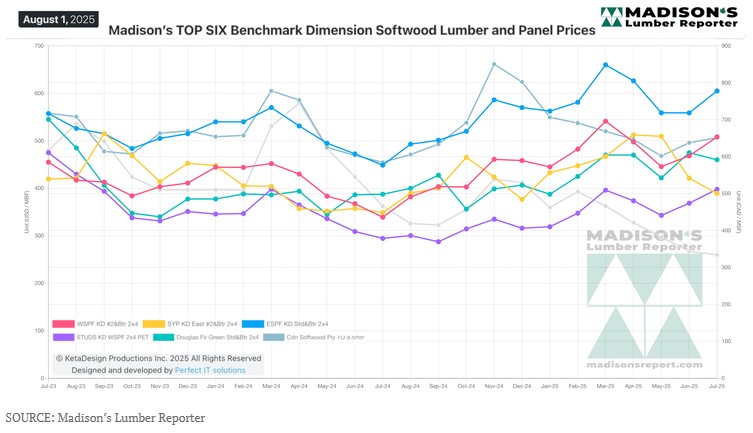

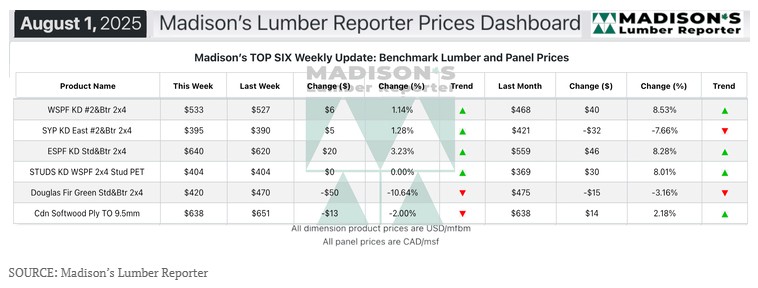

In the week ending August 1, 2025, the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was $533 mfbm, which is up +$6, or +1%, from the previous week when it was $527, according weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up +$25, or +5%, from one month ago when it was $508.

Compared to the same week last year, when it was $330 mfbm, that price was up +$197, or +60%. Compared to two years ago when it was $458, that week’s price was up +$69, or +15%.

KEY LUMBER PRICES AND MARKET CONDITIONS TAKEAWAYS JULY 2025:

- Mid-summer trading volumes were low, as usual, for sellers of Western-SPF lumber in the U.S.

- Western-SPF lumber suppliers in Canada reacted with resounding disappointment as duties imposed by the U.S. nearly doubled.

- Sawmills in Canada and customers in the U.S were factoring in these duty rate hikes to assess the effect they will have on the market.

- There was limited movement in prices as summer heat and depressed demand kept construction and buying subdued.

- A combination of trade dispute fatigue and the upcoming holiday weekend in Canada resulted in apathy and absenteeism for Eastern-SPF players.

- Suppliers of Southern Yellow Pine noted decent takeaway amid hot summer weather and vacationing buyers.

- Most SYP sawmills reported order files to within two weeks.

The Madison’s Lumber Prices Index for the week ending August 1, 2025 is: $550 mfbm. This is flat from the previous week when it was US$550 and is up +6%, or +$31, from one month ago when it was $519.

U.S. single-family homebuilding in June was down -4.6% compared to May, at a seasonally adjusted annual rate of 833,000 units, and was down -10% compared to June 2024, when it was 981,000.

In June 2025, the inventory of new single-family homes under construction in the United States was at an annual rate of 622,000, almost flat from the previous month and down -6% year-over-year.

June total housing completions were at a seasonally adjusted annual rate of 1,314,000, a -15% decrease from the May rate of 1,540,000, and a whopping -24% drop compared to June 2024's rate of 1,731,000. Single-family housing completions were at a rate of 908,000, a -13% drop from May’s 1,038,000 units.

Established in 1952, Madison’s Lumber Prices is a premiere source for North American softwood lumber news, prices, industry insight and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

Kéta Kosman is editor, owner and publisher of Madison's Lumber Report. She covers breaking news for the softwood lumber market.