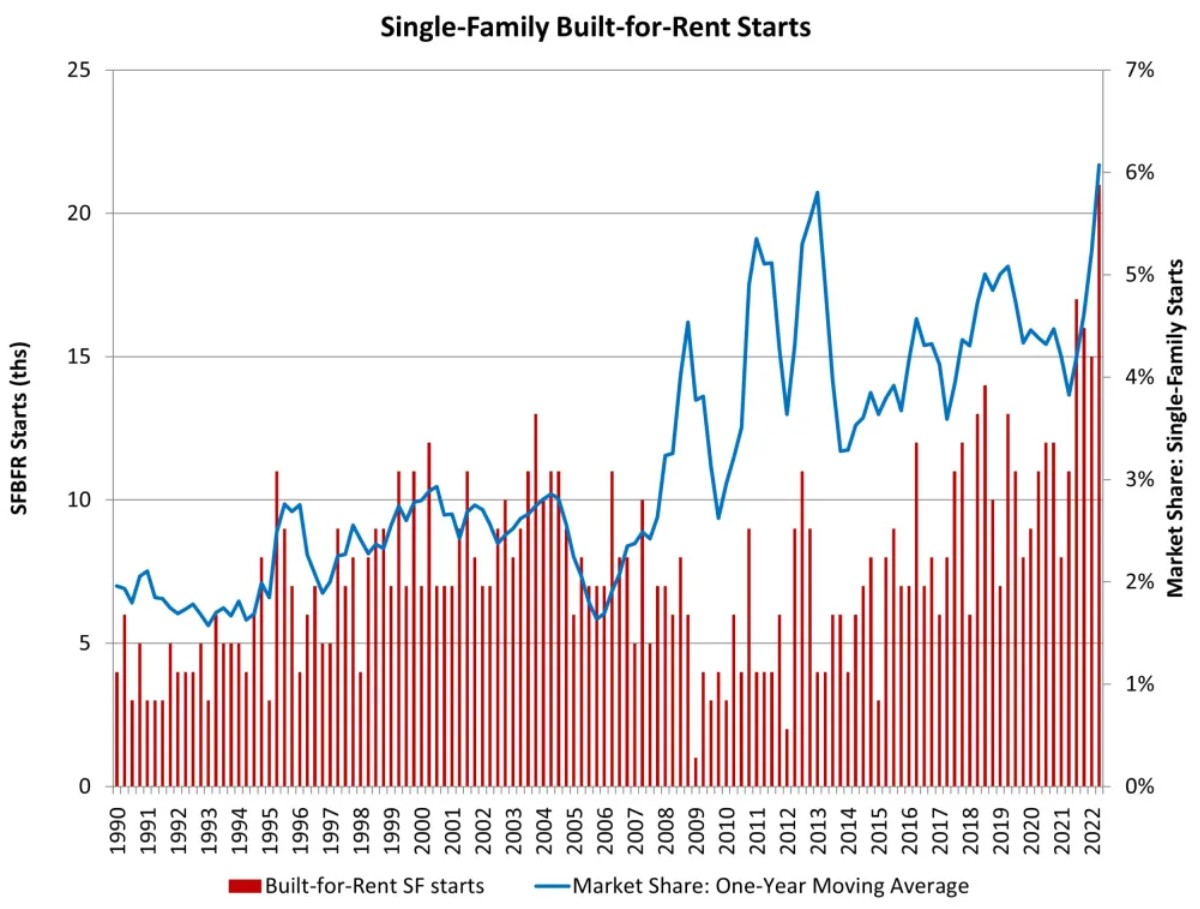

Chart: Single-Family Build for Rent Soars

Originally Published by: NAHB — August 16, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Single-family built-for-rent sector construction surged during the second quarter of 2022 as homebuying affordability declined on higher mortgage interest rates.

According to NAHB’s analysis of data from the Census Bureau’s Quarterly Starts and Completions by Purpose and Design, there were approximately 21,000 single-family built-for-rent (SFBFR) starts during the second quarter of 2022. This is a 91% gain over the second quarter 2021 total. Over the last four quarters, 69,000 such homes began construction, which is a 60% increase compared to the 43,000 estimated SFBFR starts in the prior four quarters.

The SFBFR market is a means to add inventory amid challenges over housing affordability and downpayment requirements in the for-sale market, particularly during a period when a growing number of people want more space and a single-family structure. Single-family built-for-rent construction differs in terms of structural characteristics compared to other newly-built single-family homes, particularly with respect to home size.

Given the relatively small size of this market segment, the quarter-to-quarter movements typically are not statistically significant. The current four-quarter moving average of market share (6%) is nonetheless higher than the historical average of 2.7% (1992-2012) and sets a data series high as this submarket expands.

Importantly, as measured for this analysis, the estimates noted above only include homes built and held by the builder for rental purposes. The estimates exclude homes that are sold to another party for rental purposes, which NAHB estimates may represent another five percent of single-family starts based on industry surveys. Indeed, the Census data notes an elevated share of single-family homes built as condos (non-fee simple), with this share averaging 4% over recent quarters. Some, but not all, of these homes will be used for rental purposes. Additionally, it is theoretically possible some single-family built-for-rent units are being counted in multifamily starts, as a form of “horizontal multifamily,” given these units are often built on single plat of land. However, spot checks by NAHB with permitting offices indicate no evidence of this data issue occurring at scale thus far.

With the onset of the Great Recession and declines in the homeownership rate, the share of built-for-rent homes increased in the years after the recession. While the market share of SFBFR homes is small, it has clearly been trending higher. As more households seek lower density neighborhoods and single-family residences, a growing number will do so from the perspective of renting. This will be particularly true as mortgage interest rates remain elevated and increase. Thus, the SFBFR market will expand in the quarters ahead.