Lumber Prices Hit Annual Lows

Originally Published by: HBS Dealer — December 16, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

There were no surprises for lumber industry players as December dawned. Even with so many sawmill curtailments — to ensure supply did not crest demand — lumber prices fell slightly on the usual seasonal slowdown.

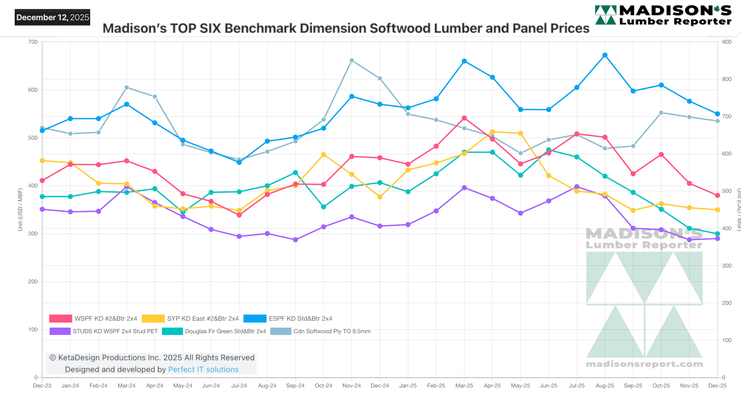

As is normal for the winter season, in mid-December lumber prices dropped to their lowest of the year. These levels, however, were quite close to where they were at the same time last year — or the year before, depending on the commodity.

Despite the tumultuous year of on-again/off-again announcements from political leaders, the trendlines for lumber prices match the previous two years quite nicely. This provides the forest products industry the ability to see what is the new economic reality for the business of making lumber following the wild volatility of both 2021 and 2022.

In some regards, the now-persistent low demand can be viewed as ominous for the looming spring housing construction season. With so many sawmills at reduced manufacturing volumes or even offline altogether, it is clear that increased supply will quite lag any boost in demand to come in 2026.

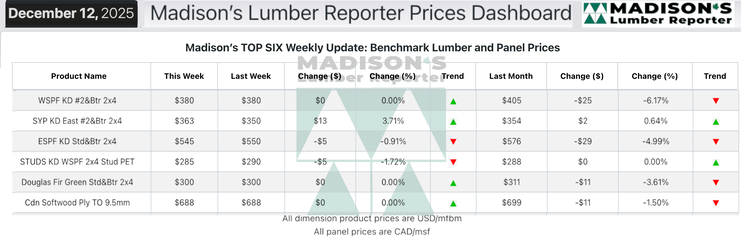

In the week ending December 12, 2025 the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was $380 mfbm, which was flat from the previous week, according to weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price was down -$25, or -6%, from one month ago when it was $405.

Compared to the same week last year, when it was $475 mfbm, that price was down -$95, or -20%. Compared to two years ago when it was $408, that week’s price was down -$28, or -7%.

Key lumber pricing and market takeaways for December 2025:

- In a trend typical for December, purchasing of Western-SPF from component manufacturers in the U.S. slowed down noticeably

- Suppliers of Western-SPF in Canada advised their customers to get some extra coverage since there was virtually no risk at current takeaway levels.

- As the reality of differing supply levels became more apparent, there were increasing reports of variable pricing between print, U.S. numbers, and those in Canadian markets.

- Some Eastern-SPF sawmills already quietly implemented soft shutdowns of their operations for the remainder of the year.

- Those ESPF mills still actively selling conspicuously stopped entertaining most counter-offers.

- Wholesalers in the East extended their positions with decent volume buys slated for shipment in the first two weeks of January 2026.

- Waning supply of Southern Yellow Pine resulted in a stalemate between buyers and sellers.

- Low-grade SYP material remained tight, particularly in the West and Central zones.

- Despite the lack of demand and takeaway, Eastern Stocking Wholesalers at the ports in New Jersey showed some optimism about the New Year.

The Madison’s Lumber Prices Index for the week ending December 12, 2025 was $434 mfbm. This was down 0%, or -$1, the previous week when it was $435 and was down -3%, or -$15, from one month ago when it was $449.

Across North America the lumber producers had booked production through to the Holiday break. For the most part folks had downtime and vacations on their minds. All eyes were on January as the extremely lean field inventories indicated a market underserved with supply for the upcoming spring building season.

Established in 1952, Madison’s Lumber Prices is a premiere source for North American softwood lumber news, prices, industry insight and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

Kéta Kosman is editor, owner and publisher of Madison's Lumber Reporter. She covers breaking news for the softwood lumber market.