Major Storms Across the Continent Keep Lumber Sales Slow

Originally Published by: HBS Dealer — February 6, 2026

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

As January came to a close, the impediment of very harsh winter weather kept sales of construction framing dimension softwood lumber items slow. It was more a matter of transportation issues than a drop in demand. Some orders were booked at prices similar to the previous week, but most communication was about organizing deliveries on icy and frozen highways.

As well, several regions of the U.S. South and East experienced power failures, which impeded sawmill operations. Most industry players, whether buyers or sellers, agreed that 2026 started off on good footing, with prices quite stable compared to the same time last year and in 2024.

All eyes were on the usual uptick in sales during February, when the largest U.S. home building companies book their wood needed for projects that will break ground in spring.

In the week ending December 12, 2025, the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was US$380 mfbm, which was flat from the previous week, according to weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$25, or -6%, from one month ago when it was $405. Compared to the same week last year, when it was US$475 mfbm, that price was down -$95, or -20%. Compared to two years ago when it was $408, that week’s price was down -$28, or -7%.

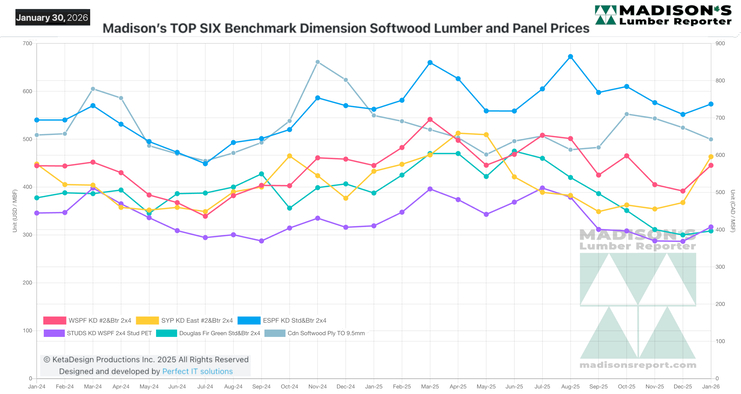

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: 2024 -2026

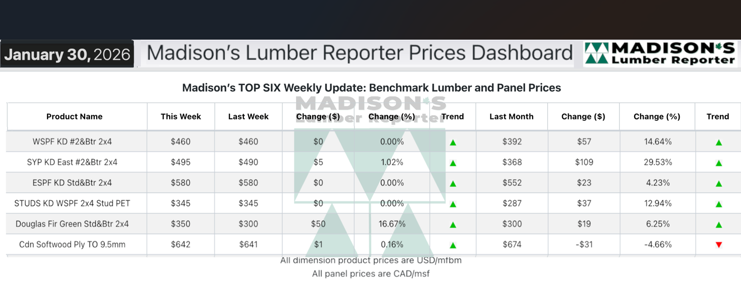

KEY LUMBER PRICES AND MARKET CONDITIONS TAKEAWAYS, JANUARY 2026:

• Even while overall availability was limited, customers of Western-SPF lumber and studs in the US remained quiet due to seasonal effects.

• Commodity prices showed consistent but not outlandish strengthening trends.

• Buyers of Western-SPF lumber in Canada retreated to the sidelines after covering the bulk of their short-term needs.

• Sawmills maintained order files into mid-February.

• Purchasers were unwilling to extend coverage beyond that timeline.

• Secondary suppliers of Eastern-SPF commodities reported sales plodded along at a relatively good pace.

• Logistical issues cropped up frequently as winter weather affected huge swathes of both Canada and the US.

• Widespread power outages over much of the Eastern portion of the continent affected Southern Yellow Pine sawmill operations.

• Eastern stocking wholesalers were content to see their prices head into February flat.

The Madison’s Lumber Prices Index for the week ending January 30, 2026 was: US$494 mfbm. This was down 0%, or -$2, the previous week when it was US$496 and was up +7%, or +$34, from one month ago when it was US$460.

Customers have become accustomed to getting the small amounts of wood they need in relatively short order so have seen no reason to build up inventory. In this context, no one knows what the market situation will be over the next few weeks. The prevailing sentiment is: to just hope there is no shock or surprise which catches people unprepared.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Established in 1952, Madison’s Lumber Prices is a premiere source for North American softwood lumber news, prices, industry insight and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

Kéta Kosman is editor, owner and publisher of Madison's Lumber Reporter. She covers breaking news for the softwood lumber market.