May Lumber Trends Show Upward Movement

Originally Published by: HBS Dealer — June 3, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

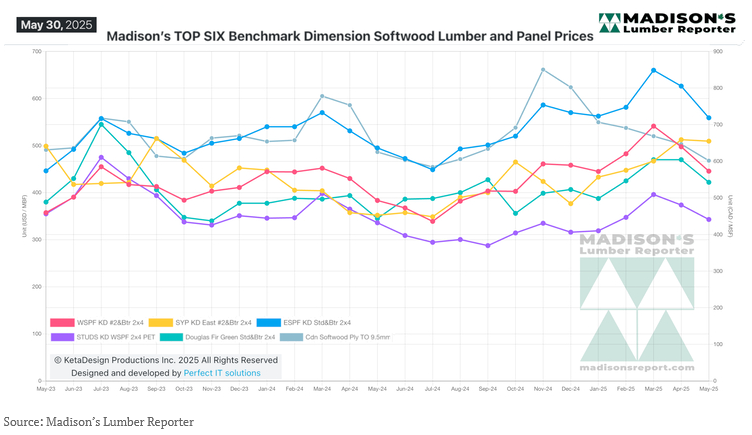

Through May, across North America, the inventories of construction framing dimension softwood lumber and panel commodity items remained low enough that customers agreed to seller list prices for most of their purchases. Counter-offers were few as buyers often searched with multiple sources to find the wood they needed. Many felt that the price bottom had been reached, thus sentiment improved and more sales were made. At sawmills the order files stretched to about two weeks.

As the month of June arrived, the seemingly entrenched habit of not stocking inventory caught up with lumber buyers. More purchases were booked at sawmills, sending prices slightly higher. The lack of supply throughout the market shifted sentiment from a “wait-and-see” approach to more active purchases. As customers had trouble sourcing the material they needed for ongoing construction projects, their main focus was on taking actual delivery. Highly populated areas like the U.S. Northeast started to see an increase in home building activity as true summer weather finally arrived.

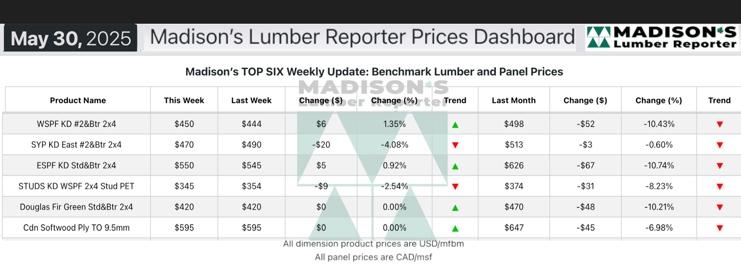

In the week ending May 30, 2025 the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was $450 mfbm, which is up +$6, or +1%, from the previous week when it was $444, according to weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up +$4, or +1%, from one month ago when it was $446.

Compared to the same week last year, when it was $383 mfbm, that week’s price was up +$61, or +16%. Compared to two years ago when it was $360, that week’s price was up +$84, or +23%.

Lumber prices and market conditions takeaways for May 2025:

• Western-SPF buyers in the U.S. continued to keep their inventories conspicuously lean.

• There was a palpable absence of pressure from end-users downstream.

• Secondary suppliers maintained thin on-ground stocks as they avoided accumulating too much of any one commodity item.

• There was noticeably less material available on Canadian Western-SPF sawmill sales lists.

• Eastern-SPF buyers were cautious with their forays, shopping around extensively.

• Southern Yellow Pine suppliers worked to track down business, while buyers twiddled their thumbs.

• Business in the busy U.S. Northeast was still confined to short-covering.

• Purchasers on the U.S. Eastern seaboard had let their inventories run so low they had to step in with new purchases.

The Madison’s Lumber Prices Index for the week ending May 30, 2025 is: $479 mfbm. This is up +1%, or +$5, from the previous week when it was US$474, and is up +2%, or +$9, from one month ago when it was US$470.

U.S. single-family homebuilding in April was almost flat compared to March at a seasonally adjusted annual rate of 927,000 units and was down -12% compared to April 2024.

In April 2025, the inventory of new single-family homes under construction in the United States was at an annual rate of 630,000, down -7% year-over-year.

April's total housing completions were at a seasonally adjusted annual rate of 1,458,000, a -6% decrease from the March rate of 1,549,000, and a -12% drop compared to April 2024's rate of 1,662,000. Single-family housing completions were at a rate of 943,000, a -8% decrease from March’s 1,025,000.

Established in 1952, Madison’s Lumber Prices is a premiere source for North American softwood lumber news, prices, industry insight and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

Kéta Kosman is editor, owner and publisher of Madison's Lumber Report. She covers breaking news for the softwood lumber market.