Q2 Sales Decline at Builders FirstSource

Originally Published by: HBS Dealer — July 31, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

With its CEO Peter Jackson describing a “challenging market environment,” Dallas-Based LBM giant Builders FirstSource reported second quarter declines in sales and earnings.

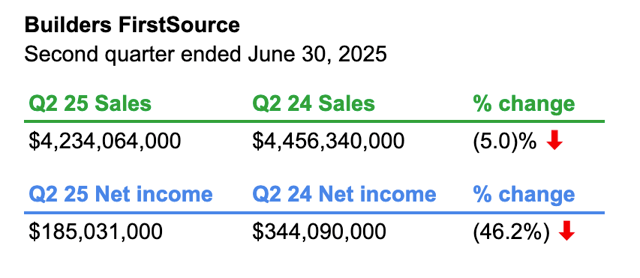

Net sales were $4.2 billion, down 5.0%. The decline was driven by lower core organic net sales and commodity deflation, partially offset by growth from acquisitions.

The company reported net income of $185.0 million. That’s down 46.2 percent from the same quarter a year ago. The decrease in net income was primarily driven by lower gross profit and higher SG&A and net interest expense, partially offset by lower income tax expenses.

During a conference call with analysts, Jackson described a focus on service and financial discipline as customers wrestle with a softer than expected housing market, ongoing affordability concerns and rising home inventories.

“Our durable results in the second quarter reinforce the advantage of our differentiated product offerings and commitment to execution. In this challenging market environment, we are prioritizing what’s within our control—serving customers with excellence, leveraging technology, and managing the business with discipline,” Jackson said. “We remain focused on building for the future through investments in value-added solutions, digital capabilities, and operational efficiency. These efforts are strengthening our position in the industry and laying the foundation to emerge stronger and accelerate delivery of long-term shareholder value as market conditions improve.”

The company broke down its end-market organic sales highlights:

• Single-family: down 9.1 percent, attributable to lower starts activity and value per start;

• Multi-family: down 23.3 percent, amid muted activity levels against strong prior year comps;

• R&R/other: up 3.3 percent, attributable to strength in the Mid-Atlantic and South Central regions.

Making deals

On the acquisition front, Jackson said BFS has developed proven “muscle memory” to grow through M&A. In the second quarter BFS acquired Truckee Tahoe Lumber, which generated prior-year sales of $120 million.

Earlier in 2025, BFS acquired OC Cluss and Alpine Lumber. Since the BFS-BMC merger in 2021, the company has made 35 acquisitions. Still, the industry remains highly fragmented, the CEO said.

"Today's market volatility makes price discovery difficult, but despite the current slower M&A environment, we are confident that inorganic investments will remain an important driver for long-term growth," Jackson said.

BFS Digital Tools are gaining traction, the company says.

Tech talk

Technology factored prominently in the presentation to investors.

Jackson trumpeted the hire of Gayatri Narayan, the new president of technology and digital solutions, and her decades of experience with Microsoft, Amazon and PepsiCo.

He said that experience will prove "instrumental as we leverage technology to enhance connectivity across our industry."

The company's offering of digital tools are gaining ground, the CEO said.

"Despite the challenging market, we have seen continued adoption with our target audience of smaller builders," Jackson said.

Since the 2024 launch, more than $2 billion of orders and $4 billion of quotes have been placed through BFS' digital tools. That's up more than 400 percent and nearly 300 percent year-to-date, respectively, compared to 2020, Jackson said.

'Operational flexibility'

Looking at the homebuilding industry overall, the company anticipates single-family starts to be down 10 to 12 percent for the year. In the face of lower sales volumes, Builders FirstSource has taken steps—"managing headcount and controlling expenses."

In the first six months, BFS has consolidated eight facilities. Still, the company has maintained on-time and in-full delivery rate of 92 percent, Jackson said.

"With our industry leading scale, experienced leadership team, and a track record of operating proactively through the cycle, we are confident that we can continue to deliver exceptional customer service," said the CEO.

Full year sales guidance

Builders FirstSource expects 2025 sales to be in a range of $14.8 billion to $15.6 billion. Annual sales in 2024 were $16.4 billion. In 2023, annual sales were $17.1 billion.

[The company's earning release is here.]