QXO Reports Third Quarter 2025 Results

Originally Published by: QXO — November 6, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

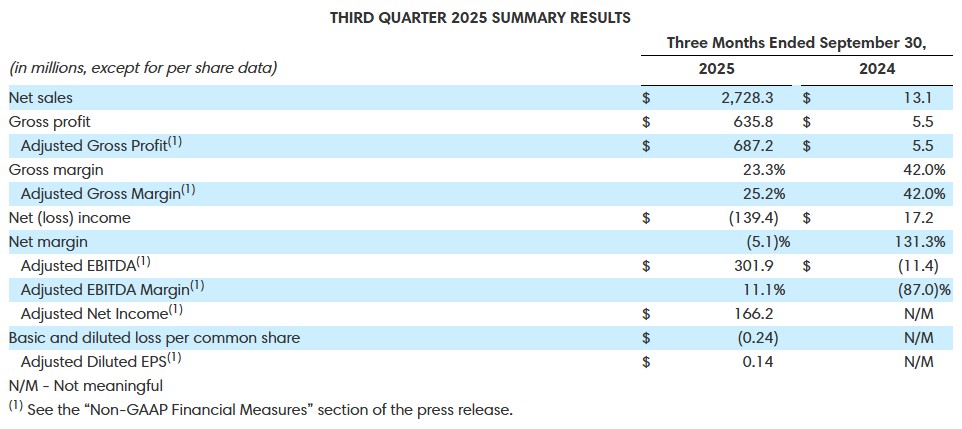

GREENWICH, Conn.--(BUSINESS WIRE)-- QXO, Inc. (“QXO” or the “Company”) (NYSE: QXO) today issued its financial results for the third quarter 2025, in line with the preliminary third-quarter information provided during last week’s term loan refinancing. The Company reported a basic and diluted loss per common share of $(0.24) and an Adjusted Diluted Earnings per Common Share (“Adjusted Diluted EPS”), a non-GAAP financial measure, of $0.14 for the three months ended September 30, 2025.

Brad Jacobs, chairman and chief executive officer of QXO, said, “We’re making excellent progress optimizing Beacon and continue to find new avenues for growth. We outperformed the market this quarter and are firmly on track to organically grow legacy Beacon’s EBITDA to more than $2 billion. This momentum, combined with a very robust acquisition pipeline, primes us to reach $50 billion in annual revenue within a decade.”

Third Quarter Highlights

Net sales were $2.73 billion for the three months ended September 30, 2025.

Adjusted Gross Margin, a non-GAAP financial measure, for the three months ended September 30, 2025 was 25.2%.

Adjusted Net Income, a non-GAAP financial measure, was $166.2 million for the three months ended September 30, 2025. Adjusted Diluted EPS, a non-GAAP financial measure, was $0.14 for the three months ended September 30, 2025.

Adjusted EBITDA, a non-GAAP financial measure, was $301.9 million for the three months ended September 30, 2025. Adjusted EBITDA Margin, a non-GAAP financial measure, was 11.1% for the three months ended September 30, 2025.

About QXO

QXO is the largest publicly traded distributor of roofing, waterproofing and complementary building products in North America. The Company plans to become the tech-enabled leader in the $800 billion building products distribution industry and generate outsized value for shareholders. The Company is executing its strategy toward a target of $50 billion in annual revenues within the next decade through accretive acquisitions and organic growth. Visit QXO.com for more information.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this press release.

QXO’s non-GAAP financial measures in this press release include: Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA, and Adjusted EBITDA Margin.

We calculate Adjusted Gross Profit as gross profit excluding inventory fair value adjustments, and we calculate Adjusted Gross Margin as Adjusted Gross Profit divided by net sales. We calculate Adjusted Net Income as net (loss) income excluding amortization; stock-based compensation; loss on debt extinguishment; restructuring costs; transaction costs; transformation costs; inventory fair value adjustments; and the income tax associated with such adjusting items. We calculate Adjusted Diluted EPS as Adjusted Net Income divided by the weighted-averaged number of common shares outstanding during the period plus the effect of dilutive common share equivalents based on the most dilutive result of the if-converted and two-class methods. We calculate Adjusted EBITDA as net (loss) income excluding depreciation; amortization; stock-based compensation; interest (income) expense, net; loss on debt extinguishment; provision for (benefit from) income taxes; restructuring costs; transaction costs; transformation costs; and inventory fair value adjustments that we do not consider representative of our underlying operations. We calculate Adjusted EBITDA Margin as Adjusted EBITDA divided by net sales.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating QXO’s ongoing performance. We believe these non-GAAP financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, QXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying business. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies.