Typical Seasonal Downturn Brings Softer Lumber Prices

Originally Published by: HBS Dealer — November 7, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

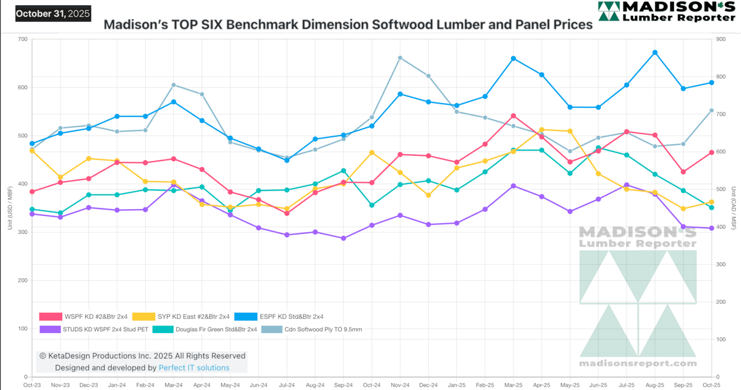

October 2025 drew to a close with the usual seasonal slowdown in lumber buying, thus some price softness. However, current levels are somewhat higher than the same week last year and in 2023.

Indeed, for benchmark softwood lumber commodity item Western SPF 2x4, this price was up +16% compared to the end of October 2024 and up +25% compared to the previous year. This confirms what Madison’s explained earlier this year—that the price trendlines over the past three years are showing a good stability.

The final push to book orders for all expected needs toward year-end was on. Sales volumes remained small, yet constrained supply helped keep prices stable. Most players agreed the writing is on the wall for the beginning of the real slowdown of construction as true winter weather approaches. Customers continued searching for prompt wood. Sentiment was still generally cautious if not downright pessimistic. Only specialty items and some panel products’ prices increased.

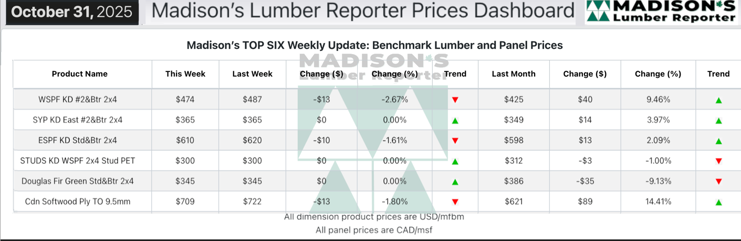

In the week ending October 31, 2025 the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was $474 mfbm, which was down -$13, or -3%, from the previous week when it was $487, according to weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price was up +$49, or +12%, from one month ago when it was $425.

Compared to the same week last year, when it was $408 mfbm, that price was up +$66, or +16%. Compared to two years ago when it was $380, that week’s price was up +$94, or +25%.

Key lumber prices and market conditions takeaways for October 2025:

• Demand and resultant takeaway for Western-SPF in the U.S. was distinctly down.

• Sawmills were clearly starting to look for business to offload their accumulated material.

• Prices of several bread-and-butter Canadian Western-SPF dimension items fell a few points.

• Thin field inventories were sufficient to furnish meager demand levels.

• Eastern-SPF buyers were uneasy about the direction of business.

• It was clear most purchasers were hoping to squeak through 2026 on the minimal stocks they have maintained.

• Southern Yellow Pine purchasers had most of their needs already covered.

• Multiple reports indicated a fickle truck market in the U.S. South.

The Madison’s Lumber Prices Index for the week ending October 31, 2025 is: $512 mfbm. This was down -2%, or -$11, the previous week when it was $523 and was up +4%, or +$22, from one month ago when it was $490.

For this year the seasonal price cycle up-and-down of Western SPF 2x4 has been a high of $550 mfbm in March and a low of $420 in September. A range of $130 throughout a year, as construction activity ramps up then wanes into winter, is a return to the usual historical amount prior to all the volatility of 2020 to 2022. This bodes well for next year of new home building, as players are now able to recognize where prices might be in the coming spring.

Established in 1952, Madison’s Lumber Prices is a premiere source for North American softwood lumber news, prices, industry insight and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

Kéta Kosman is editor, owner and publisher of Madison's Lumber Reporter. She covers breaking news for the softwood lumber market.