Lumber Prices Level Off as Autumn Dawns

Originally Published by: HBS Dealer — October 6, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

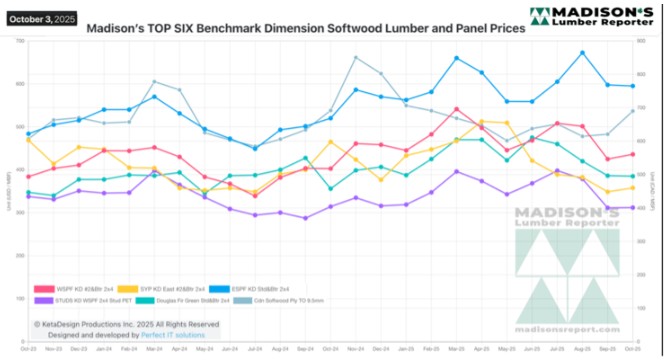

As September waned and gave way to autumn, North American construction framing dimension softwood lumber prices leveled off.

The downward corrections into summer’s end reversed to close September up slightly. Indeed, current levels were almost even to the start of this year, as well as closely matching the same weeks of last year and 2023. This is a return to a historical price trend, with regular swings up and down throughout the year as construction increases then slows down for winter.

Ongoing questions by industry folks over the past two years of what are the new price highs and lows seem to be answered. This year that annual price cycle ranged by approximately $160 mfbm, providing good price stability for operators.

While the North American lumber market showed marginal improvement, players noted these were solely due to limited supply and not related to better demand.

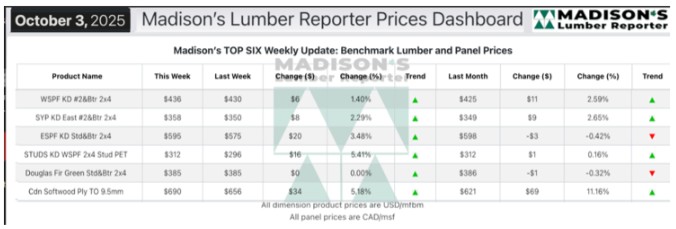

In the week ending October 3, 2025 the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was $436 mfbm, which was up +$6, or +1%, from the previous week when it was $430, according to data compiled by weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price was up +$11, or -3%, from one month ago when it was $425.

Compared to the same week last year, when it was $410 mfbm, that price was up +$20, or +5%. Compared to two years ago when it was $410, that week’s price was up +$20, or +5%.

Key lumber prices and market conditions takeaways, Aug. 2025

- Western-SPF traders in the U.S. navigated a bumpy week following the announcement of additional tariffs.

- Muted sentiment was informed by sporadic sales, perplexing pricing and overall uncertainty.

- Supply of Western-SPF in Canada was thinned out by months of curtailments, to better match weak demand.

- There was plenty of takeaway from those Eastern-SPF purchasers who felt their inventory positions were understocked.

- Sawmill order files in the East were largely into mid- or late-October as the reality of limited supply was highlighted.

- Inquiry levels for Southern Yellow Pine were decent, but resultant takeaway left much to be desired.

- Wide dimension items had firmer offerings as wetter weather in the U.S. South reduced access to larger diameter logs.

The Madison’s Lumber Prices Index for the week ending October 3, 2025 is: $485 mfbm. This is up +2%, or +$9, the previous week when it was $476 and is up +3%, or +$14, from one month ago when it was $471.

Even as demand traditionally drops at this time of year for the usual slow-down in construction activity, at the beginning of October lumber prices popped slightly. Some attributed this to the latest announcement of potential increased tariffs on Canadian lumber imported by the U.S., scheduled to come on in mid-October.

However, the ongoing reduced manufacturing volumes, which have brought supply levels down, is more likely the real reason. Customers searched wide for the lumber commodities they needed. Lean field inventories continued to make sourcing specified loads a challenge. Those sellers who did have such wood on hand were able to bump up sales prices slightly.

Established in 1952, Madison’s Lumber Prices is a premiere source for North American softwood lumber news, prices, industry insight and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

Kéta Kosman is editor, owner and publisher of Madison's Lumber Reporter. She covers breaking news for the softwood lumber market.