4 Predictions for the 2022 Housing Market

Originally Published by: Market Watch — December 20, 2021

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Here’s what reports and interviews from economists and analysts predict will happen in 2022.

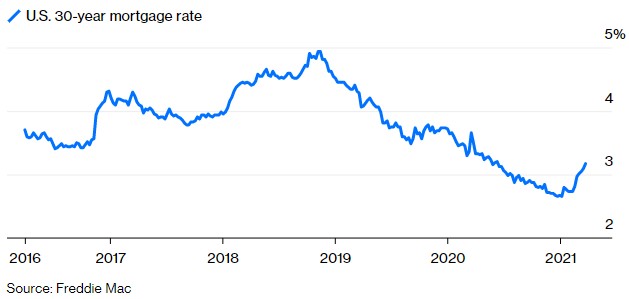

Mortgage rates will rise

Right now, we’re still facing mortgage rates near historic lows — some 30-year rates are still near 3% and some 15-year rates near 2% — but pros do predict a rise. Dr. Lawrence Yun, National Association of Realtors (NAR) chief economist, forecasts the 30-year fixed mortgage rate to increase to 3.5% by the end of 2022 as the Fed raises interest rates to control inflation. For its part, Realtor.com predicts an average mortgage rate of 3.3% throughout the year, hitting 3.6% by end of year. And Bankrate, after yesterday’s Fed meeting, simply wrote that: “Interest rate hikes, soaring inflation and a smaller bond-buying program are a recipe for higher mortgage rates in 2022.”

Home prices will rise, but at a much slower pace than in 2021 — and a lot is market dependent

The breakneck pace of housing prices in 2021 — a nearly 20% rise — will slow, but experts say prices are still likely to go up. The National Association of Realtors estimates housing prices will climb 5.7% in 2022, while Realtor.com predicts a 2.9% rise.

But there will be differences by market: “The housing sector performed spectacularly in 2021 in many markets, with huge gains achieved in places like Austin, Boise and Naples. Several markets did reasonably well in 2021, but not as strong as the underlying fundamentals suggested. Therefore, in 2022, these hidden gem markets have more room for growth,” says Yun. NAR’s top 10 hidden gem cities include places like Dallas-Fort Worth, Huntsville, Knoxville and Tucson, which are expected to experience stronger price appreciation relative to other markets in 2022.

Fewer bidding wars, but they’re still happening

Greg McBride, chief financial analyst at Bankrate, says because of the strong economy and vibrant labor market, housing demand will remain strong in 2022, but not the free-for-all it was in much of 2021. “Limited supply of homes available for sale and a restrained pace of homebuilding will keep prices elevated, but even modest increases in mortgage rates will price more first-time buyers out of the market,” says McBride. Demand will still exceed supply, especially at price points below $400,000, just not to the extent seen in 2021. “Homebuyers will continue to be frustrated by the lack of homes available for sale but there will be fewer bidding wars and homes will take a little longer to sell,” says McBride.

Kate Wood, home and mortgage expert at NerdWallet, notes that she believes that the forecast for 2022 housing market isn’t looking too different from 2021. “If the market is cooling down, it’s only by a few degrees. There are still many more buyers than there are homes for sale, particularly in the starter home price tiers,” says Wood.

Housing inventory will remain limited, but not as bad as in 2021

The National Association of Realtors notes that the U.S. has under-built housing by at least 5.5 million units, and Danielle Hale, Realtor.com’s chief economist, estimates that we’re about 5 million units short. “With homes selling and continuing to do so quickly, inventory will remain limited, but we expect to see the market rebound from 2021 lows. Inventory is expected to grow 0.3% on average in 2022,” Realtor.com notes in a new report. That’s thanks, in part, to a rising share of homeowners who say they plan to sell their homes, the report revealed.