Brooks: Impacts of Tariffs on Economy Still Far from Clear

Originally Published by: Greg Brooks, LBM Exec — June 15, 2025

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Just about everyone is confused about the state of the U.S. economy right now, and frankly it’s hard to see why. Seems obvious from here: It’s a Road Runner market.

It doesn’t matter whether we chase it off a cliff, strap it to a bomb, drop an anvil on its head, or herd it to a fake tunnel painted on a solid wall. The U.S. economy keeps chugging along regardless, in defiance of logic if not the laws of physics.

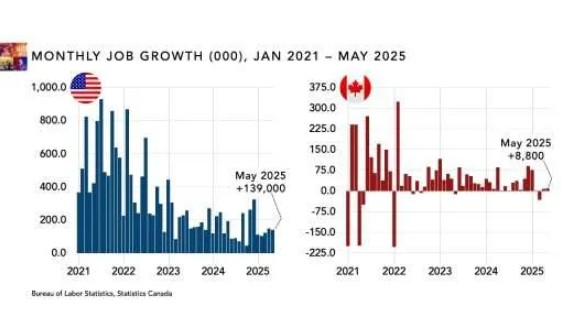

The first data from May is starting to come in now. The U.S. added 139,000 jobs last month, down from April’s 147,000. The unemployment rate held steady at 4.2% while weekly earnings growth was boringly normal: +3.9% YoY for all private sector employees, +4.0% for production and non-supervisory workers.

By comparison, tariffs have apparently begun to take a toll on Canada. Just 8,800 jobs were gained in May. The unemployment rate inched up from 6.9% to 7.0% (equal to 6.0% in the U.S.)—not a catastrophe, but “its highest level in almost nine years,” reports BNN Bloomberg.

Actually those numbers were a bit of a relief to many people. The consensus among economists had been that Canada would lose 12,500 jobs in May; instead it was in the black. Plus, the mix of jobs arguably improved: 57,700 new full-time jobs were offset by the loss of 48,800 part-time jobs.

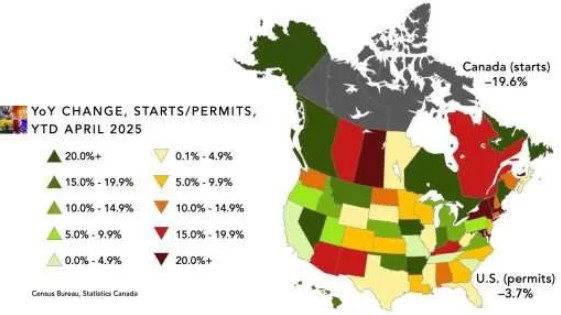

In both the American and Canadian economies, the most notable weak link has been housing. In both cases the issue is a lack of affordability, and both markets are drifting more than declining.

May data isn’t out yet, but in April, Canadian home sales fell 0.1% from March according to the Canadian Real Estate Association, and were down 9.8% YoY In the U.S., April sales fell 0.5% from March and were down 2.0% YoY according to the National Association of Realtors.

So nobody’s hitting any walls here. As always, though, Americans are better than Canadians at manufacturing drama to go with their news.

NBC called the U.S. jobs report evidence of “a labor market that continues to slow.” Fox Business reported that “added jobs in May at a slower pace than in the past two months” due to “uncertainty over the direction of trade, tax, and monetary policy.”

The uncertainty part is accurate. The notion that the job market is on a downward trajectory is not. May’s numbers were lower than April, but they were higher than March (+120,000), February (+102,000), and January (+111,000). We added more jobs in May 2025 than we did in seven of the past 12 months.

Plus, May job growth beat all the economists’ forecasts—and not just by a little bit. Just before the official BLS report was released, the consensus at Dow Jones was that we’d gain just 110,000 new jobs. ADP data indicated that private payrolls were up a mere 37,000 last month, according to CNBC.

After four months of dire predictions, the labor market is still holding its own. Wages are rising at a normal pace. The stock market has not crashed. Inflation is holding steady (2.4% in May), and as of June 13th at least, the price of gas is still below $3.00 in 20 states.

That’s why more than a few people think the notion that tariffs will undermine the U.S. economy is a bunch of “Chicken Little” hysteria. It’s possible that they’re right. So far, most Americans haven’t been hurt by tariffs, at least not badly.

On the other hand, Wile E. Coyote would be the first to tell you that falling off a cliff is not painful. It’s the landing that gets you.