New Rule Changes Ownership Reporting for Small Businesses and LLCs

Originally Published by: Foley & Lardner LLP — January 8, 2024

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

The Corporate Transparency Act (the “CTA”), which went into effect January 1, 2024, requires “reporting companies” in the United States to disclose information regarding its beneficial owners, i.e., the individuals who ultimately own or control a company, to the Treasury Department’s Financial Crimes Enforcement Network (“FinCEN”).

Reporting Companies

Reporting companies include both domestic and foreign entities. Domestic reporting companies include corporations, LLPs, or any other similar entities that are created by the filing of a document with a secretary of state or any similar office under the law of a state. Foreign reporting companies include privately formed entities and any other similar entities formed under the law of a foreign country that are registered to do business in the United States.

The CTA identifies certain exempted entities that are not considered reporting companies. Examples of exempted entities include banks, credit unions, SEC-reporting companies, insurance companies and public accounting firms.

A specific exemption exists for an entity that (i) employs more than 20 employees on a full-time basis in the United States; (ii) filed in the previous year Federal income tax returns in the United States demonstrating more than US$5 million in gross receipts or sales; and (iii) operates and has a presence at a physical office within the United States.

Beneficial Owners

A beneficial owner of a reporting company is an individual who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise (i) exercises substantial control over the entity; or (ii) owns or controls at least 25% of the equity interests of the entity.

“Substantial control” encompasses individuals who (i) serve as a senior officer of the reporting company, (ii) have appointment or removal authority over the senior officers and board of directors, (iii) can direct, determine, or have substantial influence over important decisions within the company, and (iv) have any other type of substantial control over the company.

There is no maximum number of beneficial owners who must be reported, but beneficial owners do not include the following five types of people:

- A minor child if the information of a parent or legal guardian is reported pursuant to the CTA.

- An individual acting as a nominee, intermediary, custodian or agent on behalf of another individual.

- An employee of the reporting company who is not a senior officer and whose control over or economic benefits from the company is derived solely from the employment status of the person.

- An inheritor whose only interest in a reporting company is a future interest through a right of inheritance.

- A creditor of the reporting company unless the creditor exercises substantial control over the entity or owns or controls at least 25% of the equity interests of the company.

What Must Companies Report?

Reporting companies subject to the CTA are required to provide the following information regarding the entity: (i) full legal name; (ii) trade names or d/b/a names; (iii) address of the entity; (iv) the jurisdiction of formation or registration; and (5) the federal taxpayer identification number.

For each beneficial owner, the reporting company must provide the following: (i) full legal name; (ii) birthdate; (iii) home address; (iv) an identifying number from a driver’s license, passport, or other approved documents; and (v) an image of the approved document that contains the identifying number. In lieu of (iv) and (v), an individual can apply for a FinCEN identifier number, after which the individual is permitted to use the identifier number on subsequent filings.

If the reporting company is formed on or after January 1, 2024, information related to the company applicant must also be filed. A company applicant is both (i) the individual who directly files the document that creates or registers the company, and (ii) the individual who is primarily responsible for directing or controlling the filing of the relevant document by another. If both (i) and (ii) are the same individual, that person is solely the company applicant. The same information is required to be filed regarding the company applicant as the beneficial owners.

When Must Companies Report?

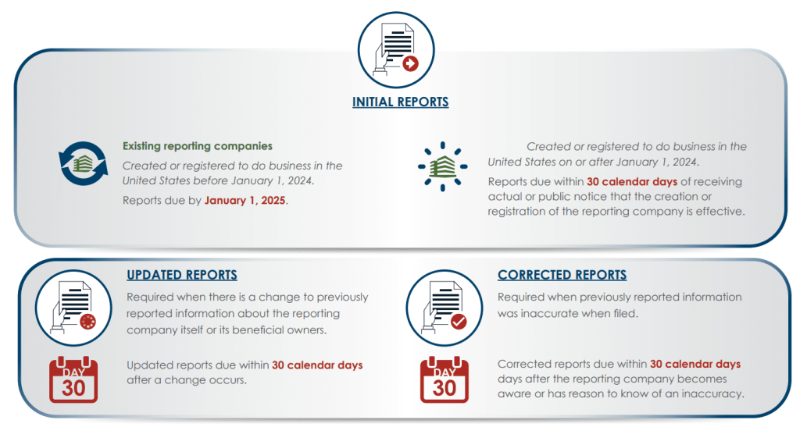

Existing reporting companies that were formed before January 1, 2024, must file their initial reports no later than January 1, 2025. Newly-formed reporting companies created after January 1, 2024, must file their initial reports 90 days after receiving notice of their creation or registration.

After the initial filing, there is no annual or quarterly filing requirement; however, reporting companies have 30 days to amend their report to include updated information. Additionally, reporting companies must correct inaccurate information previously filed within 30 days of discovering the error.

If a company is required to report its beneficial ownership information to FinCEN, the company will do so electronically through a secure filing system available via FinCEN’s website. The FinCEN BOI E-Filing System is now up and running on FinCEN’s website https://boiefiling.fincen.gov/.

While the online e-filing system is designed to be user friendly for companies to navigate on their own, many companies may choose to retain any number of third-party corporate service providers to prepare and file the reports on their behalf.

Penalties for Violating the CTA

Any person who provides false information or fails to comply with reporting requirements is liable for civil penalties of no more than US$500 for each day that the violation continue. Violators are also subject to criminal penalties of imprisonment of up to two years and fines of up to US$10,000.

Getting Ahead

In addition to being subject to criminal and civil penalties, failure to comply with the CTA could have other adverse consequences. For example, potential purchasers in a merger and acquisition or investors in a priced round financing will most likely consider confirming whether the company is a reporting company and if the company is abiding by and in compliance with the requirements set forth in the CTA.

We highly encourage businesses to determine whether they meet the definition of a reporting company, and if so, determine what must be done to comply with the CTA. Additionally, given the infancy of the CTA, it is vital for companies to make filings in a timely manner and be attentive to any updates.