Charts: Lot Market 'White-Hot', Starts to Follow

Originally Published by: John Burns Real Estate Consulting — July 26, 2021

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

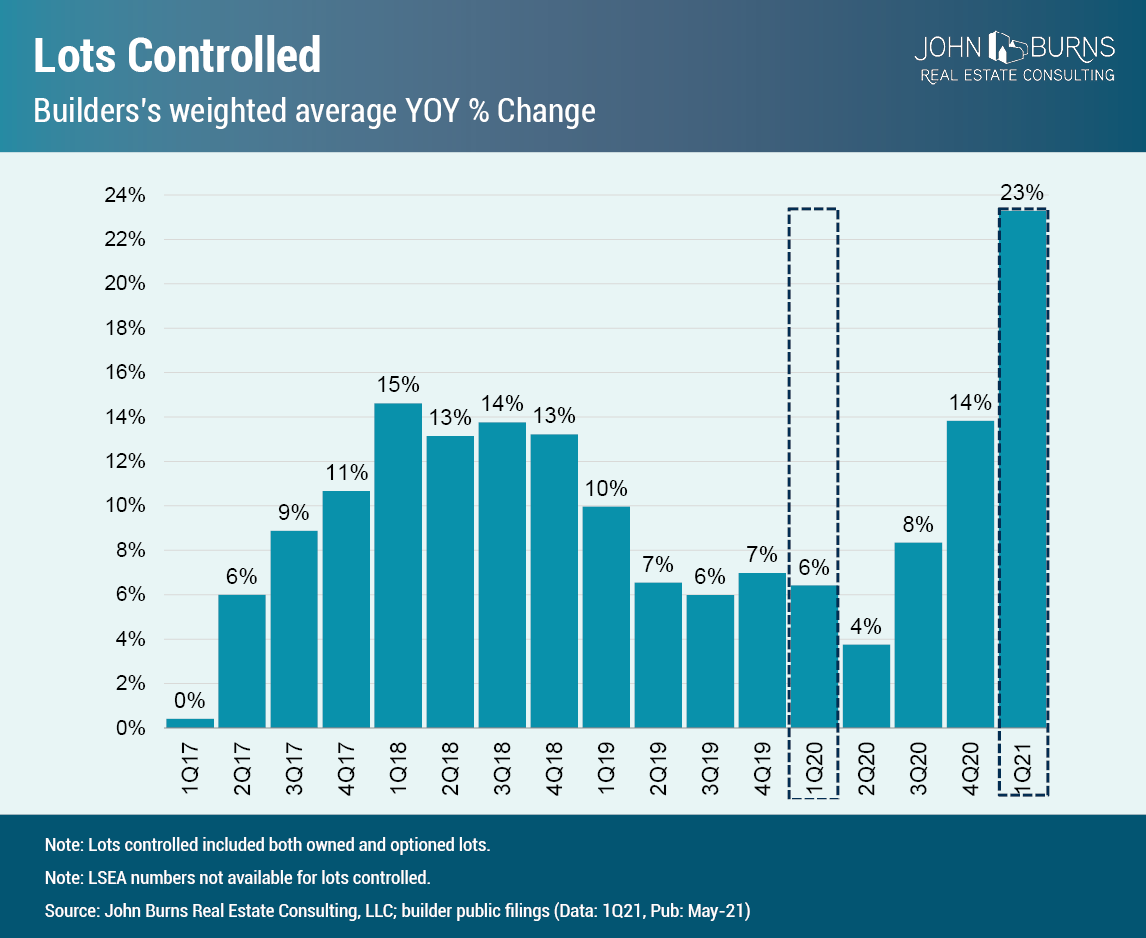

Over the next 24 months, expect home construction to boom as the number of communities will start growing again after a significant decline that has lasted more than 21 months now. Both for-sale and for-rent home builders have been on a land buying bonanza since June of 2020. The publicly traded home builders have increased their land holdings by 23% YOY through 1Q 2021. Our market feasibility consulting business for private builders has boomed as well. Builders have also paid for 30% more single-family permits in the last twelve months than the prior twelve months.

Compare that with our quarterly update for our research subscribers which shows that public builder community counts fell -17% YOY in 2Q21, the seventh consecutive quarterly decline. Clearly, the trend shown below is going to reverse.

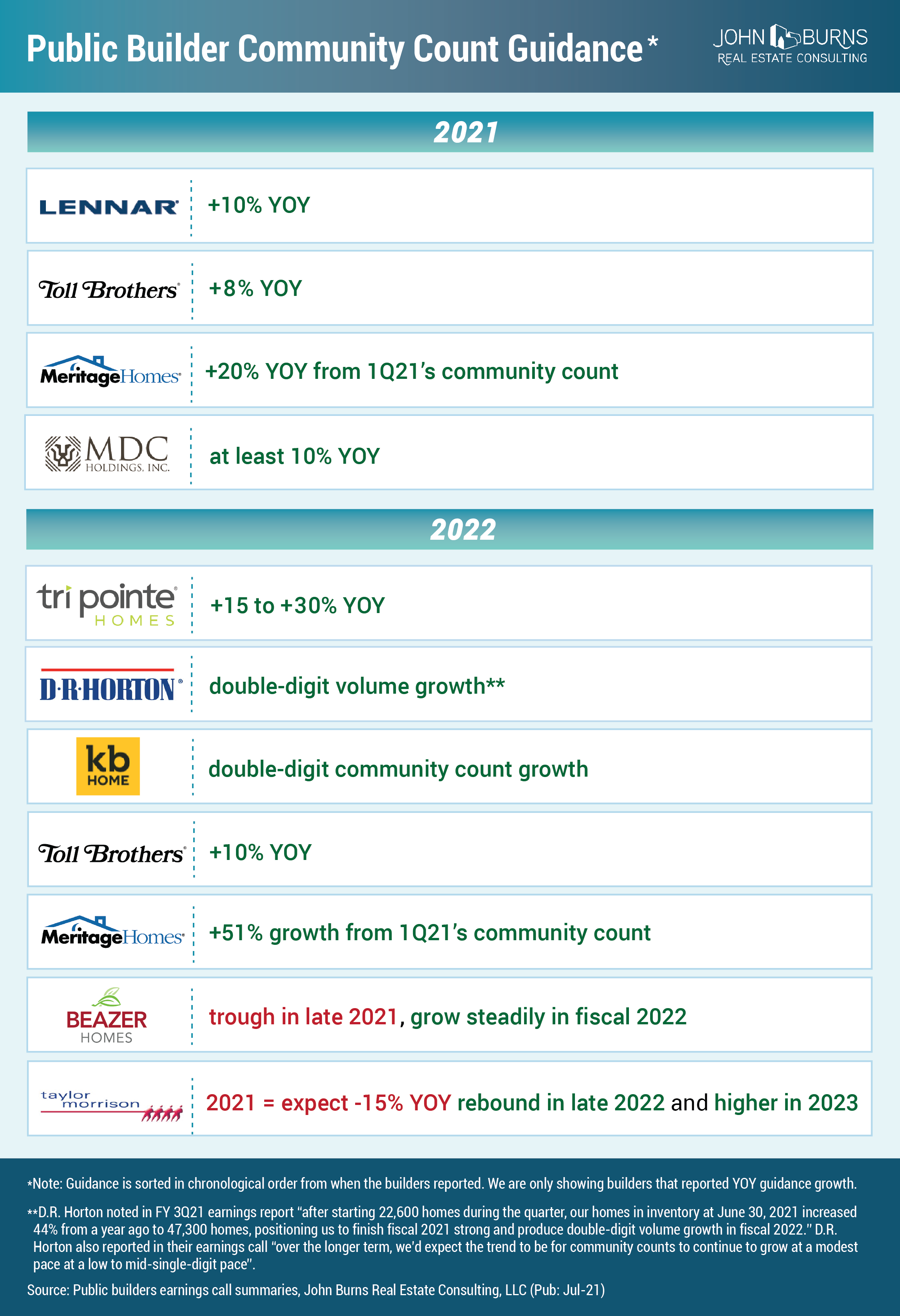

Publicly traded builders also provide great intel into what to expect, which is why we summarize their calls for our clients as well. Here is what they are saying:

Although sales have slowed a bit recently, we just closed our quarterly Residential Land Broker and Developer Survey and confirmed that the land market remains white hot.

Additionally, most of the recent land buys will consist of communities that are larger in size as disclosed by Lennar (LEN), Meritage Homes (MTH), LGI Homes (LGIH), Toll Brothers (TOL), and Green Brick Partners (GRBK), and observed by our consulting team.

The growth in more affordable markets has also boomed. Check out our recent article on The Rise of the Sister Cities as an Affordability Solution to understand a few major markets to which buyers are relocating.

All of the above represents reasons why we believe supply is coming. While this supply will be welcome by aspiring homeowners, economic forecasters, construction workers and building materials suppliers, we are already having conversations with our forward-thinking private equity and home building executive clients about "how much will be too much, and when will that happen?" We are monitoring supply metrics in every major market and price/rent range across the country, and completed a paper clarifying some very misleading reports on the U.S. undersupply of housing.