Charts: Steel Increases Offsetting Lumber Drop

Originally Published by: NAHB — October 14, 2021

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

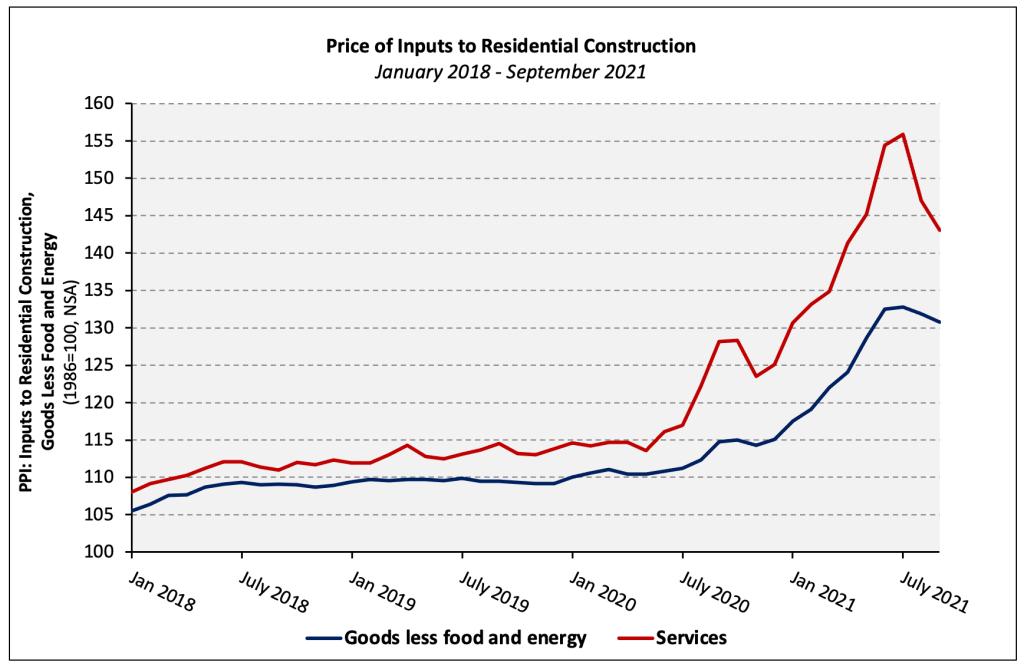

Prices paid for goods used in residential construction ex-energy decreased 0.8% in September (not seasonally adjusted), according to the latest Producer Price Index (PPI) report released by the Bureau of Labor Statistics. The decrease was largely driven by lower lumber and concrete products prices and was the second monthly decline since the start of the last recession. The price index of services inputs to residential construction also decreased in September, driven by smaller gross profit margins of building materials retailers.

Despite the monthly decline, building materials prices remain 13.9% higher than they were 12 months earlier and are 11.3% higher than they were in January 2021. Prices increased 4.4% over the same period in 2020. In contrast, the price index of services inputs to residential construction has increased less in 2021 (+9.5%) than it did over the first nine months of 2020 (+11.9%).

Goods

Softwood Lumber

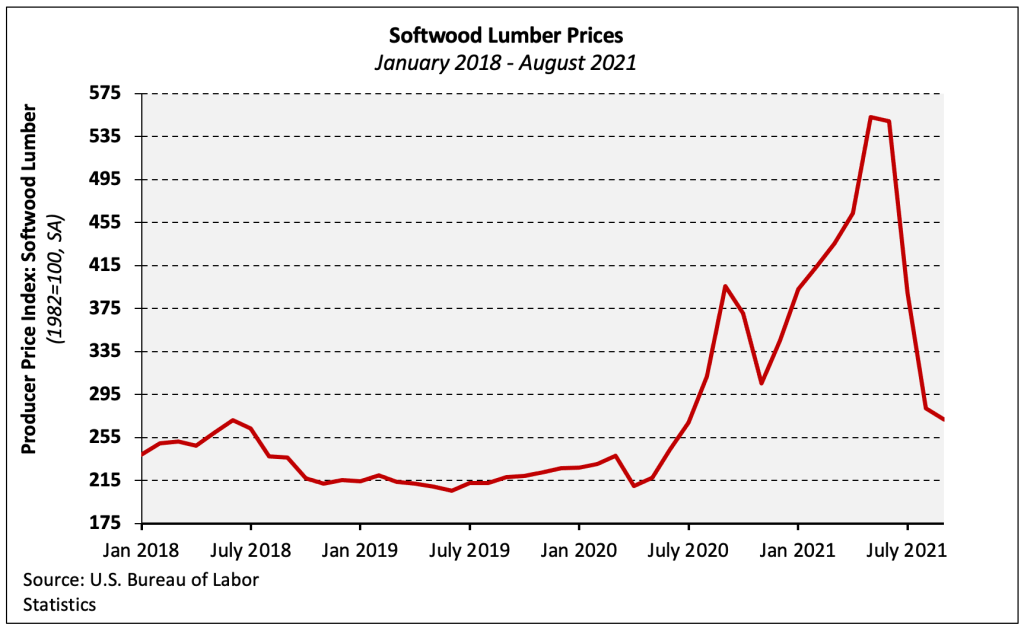

The PPI for softwood lumber (seasonally adjusted) decreased 3.5% in September after declining 29.0% and 27.7% in July and August, respectively. The slowing of monthly price declines is consistent with cash prices one month earlier, as measured by the Random Lengths Framing Lumber Composite Price (FLCP), as week-over-week declines slowed in August before beginning to increase in September.

The PPI of most durable goods for a given month is largely based on prices paid for goods shipped in the survey month. This can result in lags relative to cash market prices during periods of long lead times. The FLCP has increased 36.0% since reaching its most recent trough on August 27th, suggesting the softwood lumber PPI will increase in October.

Ready-Mix Concrete

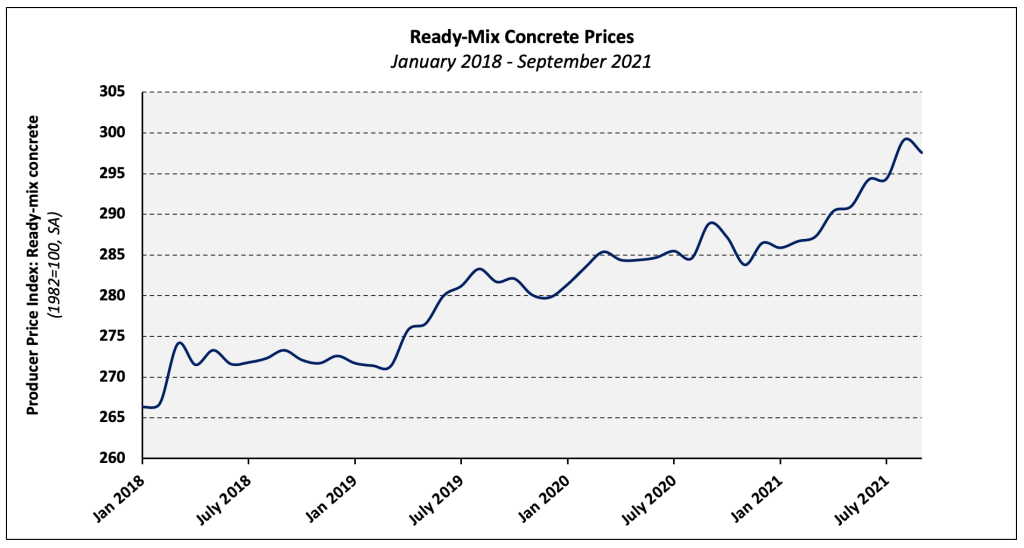

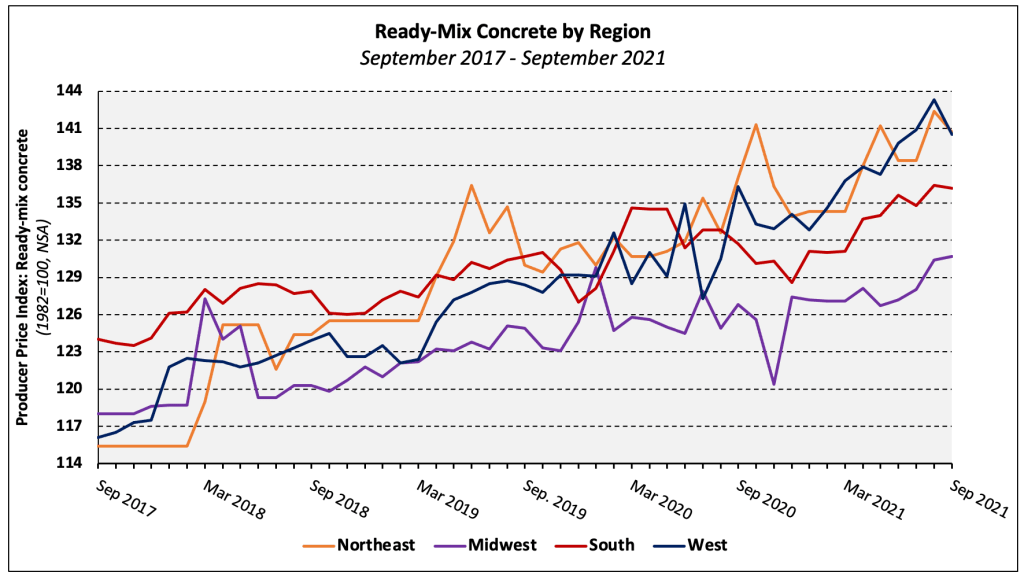

The PPI for ready-mix concrete (RMC) decreased 0.5% in September, the first decline since January 2021. The index for RMC has risen 3.0% over the past 12 months and 4.1% YTD—the largest year-to-date increase in September since 2006.

Prices decreased in three of four regions with the largest decline occurring in the West (-2.0%). Prices fell 1.2% and 0.1% in the Northeast and South, respectively, and increased by 0.2% in the Midwest.

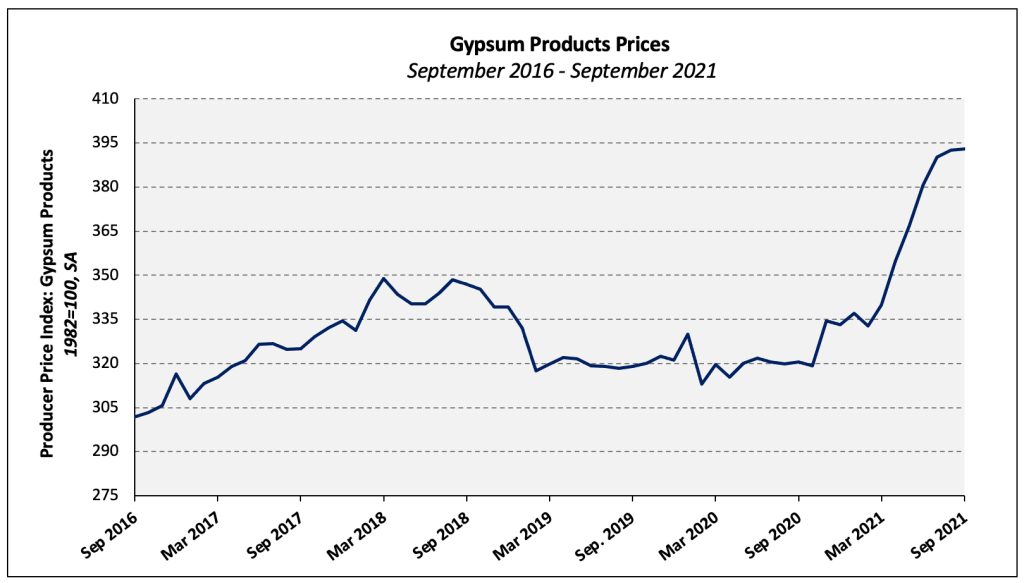

Gypsum Products

The PPI for gypsum products increased 0.1% in September—the seventh consecutive monthly increase. Although gypsum products prices fell 2.8% between January and September 2020, the index has increased 16.6% YTD in 2021 and 22.6% over the past 12 months.

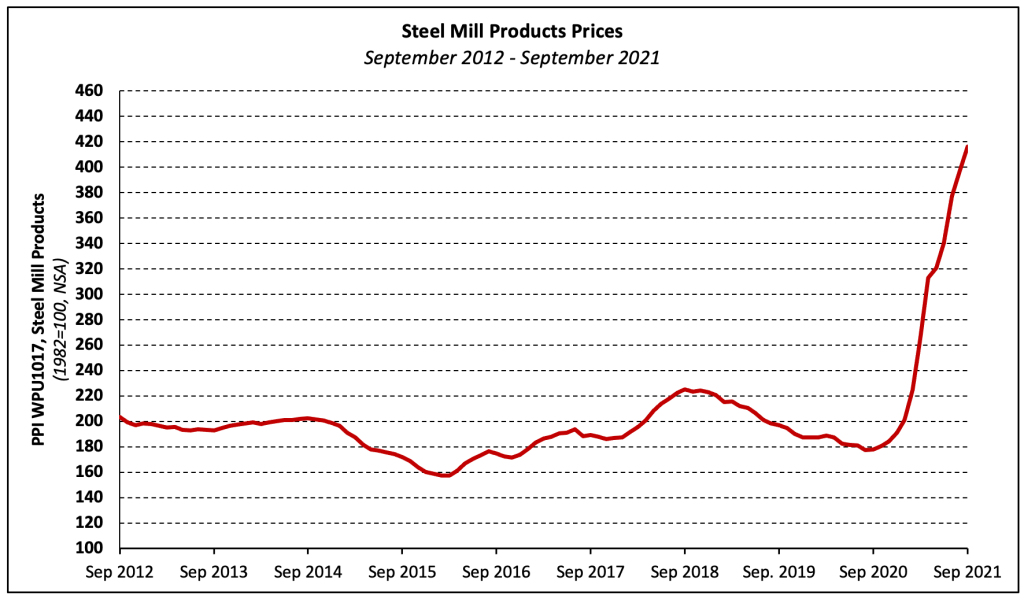

Steel Products

Steel mill products prices climbed 5.0% in September following a 5.1% increase in August. July 2020 was the last month prices declined—they are up 134.1% in the 14 months since.

The monthly change in the steel mill products PPI increased by more than 10% only three times (in 1947, 1948, and 2008) over the 80-year period ending in 2020. Monthly increases have exceeded that mark four times in 2021.

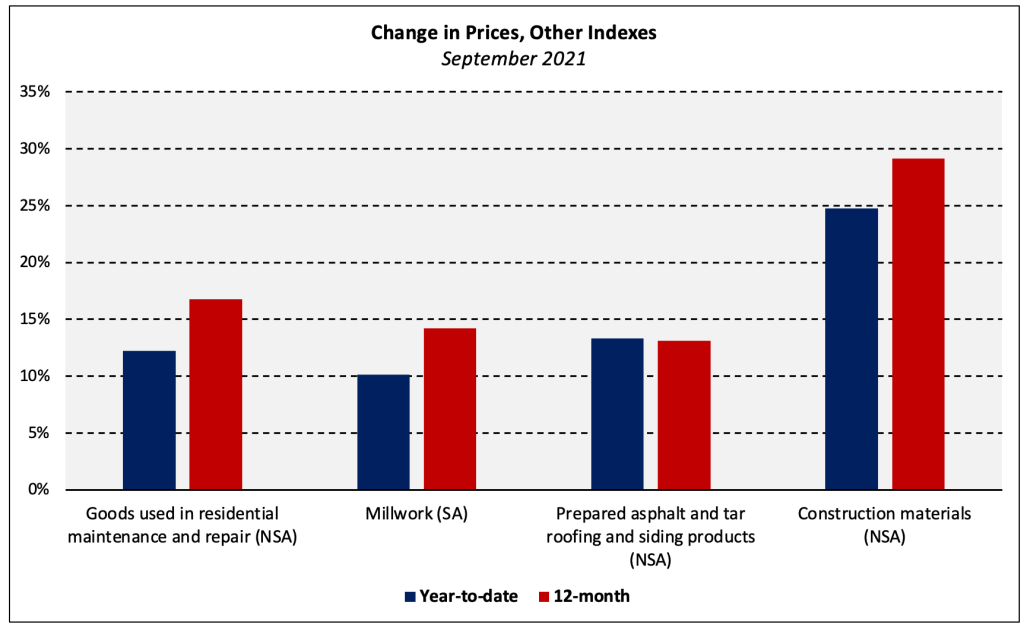

Other Building Materials

The chart below shows the 12-month and year-to-date price changes of other price indices relevant to the residential construction industry.

As Congress continues to work on an infrastructure package, the Construction Materials index is particularly salient. This index, which has increased 23.9% year-to-date and 32.1% over the past 12 months, is much more heavily weighted with products used in large amounts in the production of “traditional” infrastructure (e.g., roads, bridges, rail).

Services

The price of services used as inputs to residential construction decreased 2.7% in September after falling 5.7% in August. The monthly decline was entirely driven by a 3.7% drop in the prices for trade services inputs, the index which accounts for roughly two-thirds of the PPI for “inputs to residential construction, services.”

The trade services PPI measures changes in the nominal gross margins for goods sold by retailers and wholesalers. Unsurprisingly, hardware and building materials retailers make up the majority of trade services included as residential construction inputs. The PPI for building materials retailers decreased 5.9% in August while nominal gross margins for building materials wholesalers increased 3.6%.