Why Modular Construction Continues to Lag Behind

Originally Published by: Construction Dive — March 23, 2022

SBCA appreciates your input; please email us if you have any comments or corrections to this article.

Permission granted by Hoar Construction

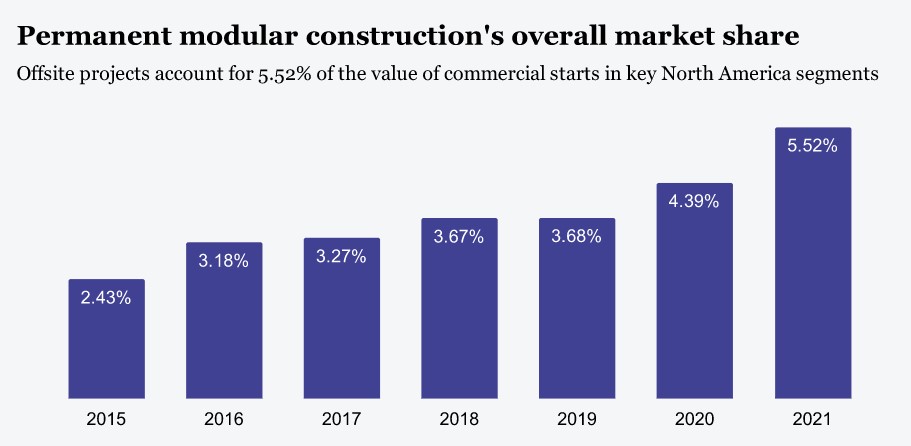

Visions were grand, forecasts ambitious: Permanent modular construction would change the industry, saving time, money and the environment. But years after its initial adoption in the U.S., it accounted for just 5.5% of new construction last year in North America, according to the Modular Building Institute (MBI).

Despite promised cost savings, environmental benefits and quicker return on investment, contractors are still running into roadblocks using modular construction. Many face a steep learning curve, and there can be snafus with design, manufacturing, transportation and assembly, they say.

"On paper, and if all goes according to plan, modular construction should result in both time and cost savings. But modular techniques have not cracked the code fully on commercial, and other more complicated, construction types," said Raja Ghawi, partner at Era Ventures, a proptech-focused venture capital firm, who previously worked as an investment director at Boston-based Suffolk Construction.

Of course, many construction pros vouch for modular’s potential, especially in certain market sectors.

Sebastian Obando/Construction Dive, data from the Modular Building Institute

"Over the past five years, we doubled market share … my expectation is that the market share will double again to 10% over the next five years for many of the same reasons it’s growing now," said Tom Hardiman, executive director at MBI.

"More owners and architects understand the process, tight labor markets, massive housing shortages — none of those factors will change to negatively impact the industry over the next five years," he said.

Turner Burton, president of Hoar Construction, a Birmingham, Alabama-based construction company, said modular construction is starting to click especially in the healthcare sector. The repetitiveness of identical patients' rooms or bathroom pods sets up well for a modular operation.

"You have to consider and plan for every step of manufacturing, transport and installation," said Burton. "You have to have the people who will be installing and putting those pieces together in one room."

For example, trade partners were involved in the design phase of a current Hoar project (pictured above) to ensure the fully prefabricated exterior panels could be picked up by a crane and then placed on the building exterior.

Modular has also made inroads in the hospitality industry, with marquee names such as Hilton and Marriott giving the thumbs-up.

Contractors also appreciate the green and safety benefits. Around 88% of contractors said modular construction reduced construction waste, according to a 2020 Dodge SmartMarket report.

At the same time, construction on a factory floor eliminates the potential for falls, the No. 1 cause of construction deaths. About 89% of respondents indicated modular provides a safer worksite, according to Dodge.

Modular buildings also take 25% to 50% less time to build than traditional methods, which means faster occupancy and return on investment, according to the MBI.

Why modular hasn't stacked up so far

Nevertheless, contractors say certain challenges in modular projects have stalled its progress. One of the biggest is the new way of approaching each job.

"Everyone needs to stop and unlearn what they know about building for a moment and relearn how this modular stuff has to be sequenced, staged, orchestrated and coordinated with all the infrastructure," said Jared Bradley, president of The Bradley Projects, a Nashville, Tennessee-based architecture firm. "That's just a completely different learning curve."

Workers build the exterior skin panels for a Hoar Construction modular project in a warehouse. Permission granted by Hoar Construction

Architects, consultants, general contractors, subcontractors need retraining, including how to monitor quality and track progress, said Ghawi.

Another challenge is the fact that the initial savings can often be wiped out by design, manufacturing or execution errors on site, said Ghawi. That could range from issues with the kits of parts assembly, shipping and handling from the factory or proper installation techniques.

Modular's pre-assembled components also undercut some subcontractors, notably highly skilled trades like plumbers, electricians and steel workers, said Scott DeLano, principal at Certified Construction Services, a Nashville, Tennessee-based general contractor.

The modules "are already pre-plumbed, they're pre-wired, and we are basically just providing foundations, landscaping, grading work and all the infrastructure that has to happen for those things to have a home to sit on when they show up," DeLano said.

The methods are so dissimilar and used so infrequently that it can be difficult for contractors and subs to get into a cadence.

"As soon as you finish a modular project, you're back to the conventional methods for a year or two, or three or four, whatever it is, and then all of a sudden, someone comes up with another modular project," said Bradley. "And everyone's got to rethink everything from before."

Preventing damage during transport is another problem.

"To build and transport a modular bathroom or a modular unit requires additional structure beyond what is required to build in the field," said a senior executive at a general contractor who asked not to be identified for fear of upsetting potential business partners. "You actually end up putting more material into a prefabricated module than you would if you were just building something efficiently on a jobsite."

With material prices at a 35-year high, any extra cost is disdained.

"For prefabricated construction, this is why it is important to establish consistency and repetition, so you can maximize the efficiency of production to offset additional requirements for rigidity and stability in transport," the senior executive said.

Growth ahead

Despite the hurdles, modular's market share is expected to grow. Homes built with a modular process use about 17% less material overall, for example, according to MBI.

Cloud Apartments, a modular housing development company, claims its construction process is 30% more cost effective.

And even Bradley, the contractor who mentioned the steep learning curve, still sees a place for it in his business.

"There is a time and place for everything, and there's a time and place for modular construction," Bradley said. "It's always one tool in our toolbelt. But I don’t think it’s ever going to be our main tool."